Why 'Vertical Volatility' Is the Missing Link in Your Keyword Strategy - Animalz

Why ‘Vertical Volatility’ Is the Missing Link in Your Keyword Strategy

As content marketers, we base our keyword strategies on the most accessible—and simplest—data points we have: domain ranking, monthly search volume, and keyword difficulty. Often, keyword strategies built on those basic data points work.

Sometimes they don’t.

Certain industry verticals require a different approach to keyword strategy. Verticals in a state of flux, in which technology, terminology, and best practices change rapidly and radically, require a keyword strategy built to take risks and pivot rapidly. Static verticals, in which change is incremental, require a slow and steady strategy.

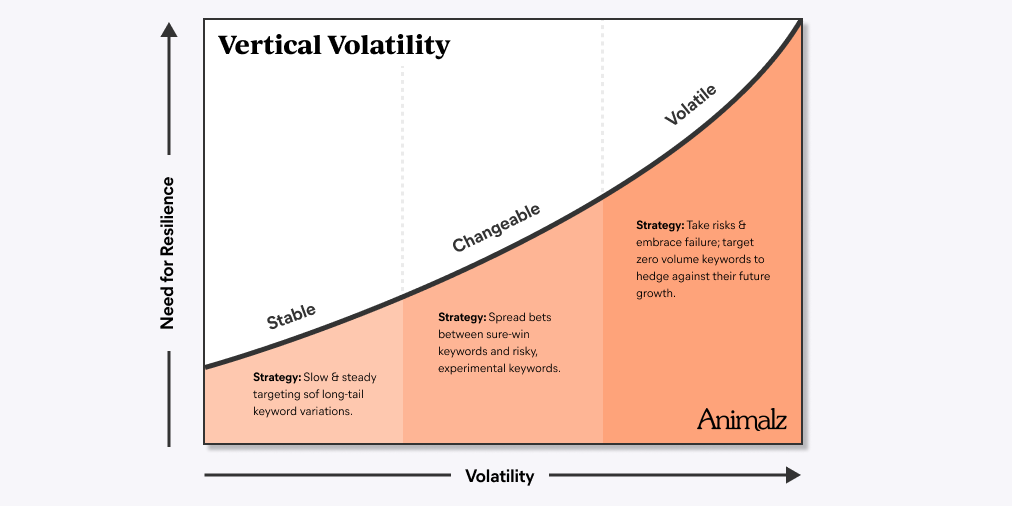

We use a vertical volatility model to help us map where our industry falls on this spectrum. Much as volatility models in finance allow investors to forecast the potential for change and modify strategies accordingly, mapping vertical volatility allows content marketers to estimate the potential for fluctuation in SERPs and design a keyword strategy with volatility in mind.

What Vertical Volatility Looks Like

Vertical volatility can’t be ascertained by looking at frequency or extent of fluctuations in search engine results pages. Fluctuations are a lag indicator of volatility.

Instead, volatility is driven by external factors in the business environment, such as technological innovation and intensity of competition. The more disrupted the vertical, the more changeable the keywords, their volume, and the meaning of those keywords. This is played out in fluctuating search engine results pages, as new players enter the content marketing fray.

Take the example of retail. With its slew of “apocalyptic” bankruptcies and rapid technology changes, retail is a vertical in which new volatility is the norm. New terminology rises and falls rapidly, and keyword strategies have to be able to respond to those changes.

Other verticals are relatively stable. Something like team or employee engagement falls into this category: established competitors appear repeatedly in search results, and the language and practices of the vertical are recognizable from a decade ago. While we’ve moved employee engagement tools online, there has been no radical break from how we think about engagement.

Where your industry falls on this volatility spectrum has a direct impact on keyword strategy.

The Vertical Volatility Model

We’ve arranged the external factors driving change into a vertical volatility model. Before defining a keyword strategy, we’ll decide where our vertical sits on the spectrum.

Stable Verticals

In stable verticals, there’s little change in terminology, and few new applications emerge for your product over extended stretches of time. Technological change is incremental, building on previous innovation in a predictable way.

This manifests in SERPs through fixed search intent for core topics or ideas, and few new page-one players. Breaking into the top 10 results is tough, but once you’re in there it’s unlikely you’ll fall.

Stable verticals of this sort will see predictable returns from a slow and steady approach targeting long-tail terms.

Take the example of Uptick, a tool to help people have better 1:1 meetings. Uptick sees seasonal fluctuations in search volume around the annual performance review cycle, but these fluctuations are predictable both in terms of when they’ll happen and by how much interest will fluctuate. There are incremental—not disruptive—changes happening to the technology used to run 1:1s, and Uptick’s competitors are well established.

This stability is reflected in the top three SERP results for core topics, such as “performance reviews,” which has held steady for more than two years:

Search results for the keyword “performance review” have remained the same for 24 months, with only a brief shuffle in February 2020 before returning to the status quo.

In such a stable SERP situation, Uptick can afford to target keywords slowly over time, without fear of new entrants and technologies suddenly rendering years of effort obsolete. They can also focus on one or two content lanes, as the need for rapid pivots are unlikely.

Uptick does this by targeting long-tail terms for tightly defined audiences (for example, managers who manage managers), and writing thought leadership posts with niche appeal.

With this slow and steady approach to building keyword rankings, growth is initially incremental and then reaches an inflection point at which organic traffic begins to compound, seen here toward the end of 2020:

Uptick’s blog saw slow yet steady organic traffic growth until the end of 2020, when they reached an inflection point and growth began to speed up.

Uptick can expect steady, incremental improvements across every keyword as long as their vertical remains stable. Over time, they’ll edge into page-one positions for long-tail terms and then can start to target lower competition short-tail terms in the same incremental way.

Changeable Verticals

Changeable verticals are those under the influence of both disruptive and stabilizing factors. For example, a changeable vertical may have a disruptive new technology, but that tech has already been acquired by established behemoths that dominate SERPs. Intense competition may be a factor to contend with, but who the actual competitors are could stay stable over months and years.

In changeable verticals, you may see new relevant keywords appear frequently and old terms lose volume fast, but few new players manage to break into page one of SERPs; instead, it’s a dogfight between established sites.

Changeable verticals are best served by a bet-spreading keyword strategy, in which the majority of effort is invested in sure-win keywords, and a portion is reserved for risky, experimental keywords and content.

Auth0, leaders in the disrupted space of identity and authentication, is a case in point. Technological innovation and frequent changes to legislation and best practices are common in this vertical.

Despite that volatility, Auth0’s sector has some counterweights that add stability. The competitor landscape is relatively unchanging, and the main players are well funded; Auth0’s two direct competitors have received combined funding of over half a billion dollars over their life spans. The dominance of these players creates a barrier to new entrants in the field, and in SERPs.

The vertical’s mixed volatility is reflected in the past two years of position history for main term “authentication.” There’s jockeying for position among established players, but no new sites have broken into SERPs:

SERPs for Auth0’s central keyword “authentication” exhibit some some changeability as top players jockey for position; however, there have been few new entrants to the race in the past two years. There’s a mix of stability and volatility in SERPs.

Faced with a changeable vertical, Auth0 applies a version of Nassim Taleb’s barbell strategy. This means the company invests the majority of their effort (and SEO dollars) in safe-bet keywords they know they can rank for; the remaining time and budget goes toward risky bets—topics and terms that may or not become relevant for their vertical at some point in the future.

Their safe bets include developer-centric content, which is tactical enough to weather most changes within the vertical and speaks to an audience they’ve had for years.

They combine these safe bets with definitional content for rising trends and keywords. These terms may take off among target users, or they may flop. That’s a risk that Auth0 has to take if they want to remain at the top of SERPs as they evolve.

Volatile Verticals

In some verticals, new technologies regularly disrupt the status quo, and VC dollars go to the most disruptive of these innovations, perpetuating a cycle of even greater experimentation. Few players have achieved market dominance, and there’s intense competition as companies position themselves.

The SERPs for these verticals see fast-rising keywords emerge frequently, with both large and small sites scrapping for dominance. In volatile situations, there’s a chance for a small site with low DR to beat out a bigger site if the small site is the first to target an emerging keyword or trend and build reputable backlinks fast.

Content marketers in volatile verticals need to take more risks, such as targeting keywords with zero volume to hedge against their future growth. Expectations need to be adjusted appropriately: 90% of what you try may fail, but the 10% that does work may drive large and rapid growth in traffic and keywords.

As a collaborative learning platform targeting enterprises, 360Learning is in a volatile vertical. In 2020, startups in edtech raised over $2.2 billion in venture and private equity capital, up 30% from the prior year. More deals were also made overall: 130 in 2020 as compared to 2019's 105. This surge in volatility is mainly a product of 2020's Black Swan event, COVID-19, which had a big impact on online education.

Edtech sites saw average growth of over 70% in the same period, according to the Animalz Content Marketing Benchmark Report. We can see the impact of this trend on SERPs if we look at rankings for the generic term “online education” over all time. After many years of stability, things got volatile in mid-2020:

After years of stability in “online education” SERPs, some new players started to enter page-one results from 2019. 2020 pushed the SERPs into volatility, with new sites vying for page-one spots and a lot of movement as sites lost, regained, and lost their rankings again.

Volatility means more opportunities for new players to break into SERPs. 360Learning can do that in different ways: for example, by targeting new emergent keywords in the hope they’ll gain traction in the future, or by aggressively chasing existing big-volume keywords in the hope of beating out the competition. The idea is to win poll position on a wide range of keywords that are both directly and indirectly related to the product; that way, when disruption occurs in the marketplace and SERP volatility strikes, you have a good chance of already ranking for some of the rising keywords.

360Learning have used this approach, rapidly building topical authority through hub/spoke structures. In less than 12 months, this has created vertiginous growth in ranking keywords for the site:

In 2020, 360Learning has experienced hockey-stick growth in keywords, building rankings from 0 to over 6,000 in six months.

This kind of “go big or go home” strategy comes with a caveat: Expect 90% of the content to be unsuccessful and growth to come from 10% of hyper-successful pieces.

The Future May Be Volatile, But Keyword Success Shouldn’t Be

Domain ranking and product-intent fit are still important when defining a keyword strategy for content. But the top keyword strategies have resilience against volatility built into them. Planning your strategy based on what you see right now in SERPs isn’t good enough; instead, plan based on your vertical’s potential for volatility. Mapping where your vertical falls on the volatility scale helps set keyword approach and defines what “success” will look like.