What is Accounting and Why is it Important For Your Business? | Bench Accounting

A simple definition of “accounting”

Accounting is how your business records, organizes, and understands its financial information.

You can think of accounting as a big machine that you put raw financial information into—records of all your business transactions, taxes, projections, etc.—that then spits out an easy to understand story about the financial state of your business.

Accounting tells you whether or not you’re making a profit, what your cash flow is, what the current value of your company’s assets and liabilities is, and which parts of your business are actually making money.

Accounting vs bookkeeping

Accounting and bookkeeping overlap in many ways. Some say bookkeeping is one aspect of accounting. But if you want to break them apart, you could say that bookkeeping is how you record and categorize your financial transactions, whereas accounting is putting that financial data to good use through analysis, strategy, and tax planning.

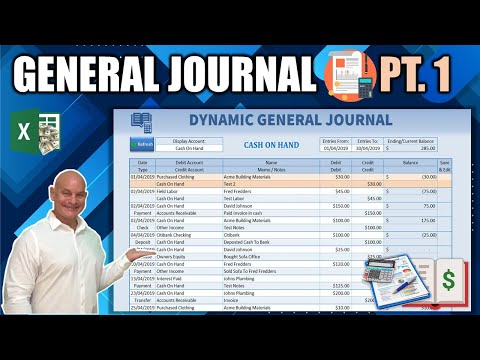

The accounting cycle

Accounting begins the moment you enter a business transaction—any activity or event that involves your business’s money—into your company’s ledger.

Recording business transactions this way is part of bookkeeping. And bookkeeping is the first step of what accountants call the “accounting cycle”: a process designed to take in raw financial information and spit out accurate and consistent financial reports.

The accounting cycle has six major steps:

- Analyze and record transactions (looking over invoices, bank statements, etc.)

- Post transactions to the ledger (according to the rules of double-entry accounting)

- Prepare an unadjusted trial balance (this involves listing all of your business’s accounts and figuring out their balances)

- Prepare adjusting entries at the end of the period

- Prepare an adjusted trial balance

- Prepare financial statements

Most of these rules and processes are automated by accounting software, so we’re going to skip over the gritty details of the accounting cycle and talk about the end product: financial statements.

Meet Kaitlyn. Your new bookkeeper.

Start a free trial with Bench. We’ll take bookkeeping off your hands, pairing you with a real, human bookkeeper—like Kaitlyn—at a price you can afford. We’ll even get your taxes filed for you.

Financial statements

Financial statements are reports that summarize how your business is doing, financially.

There are three main types of financial statements: the balance sheet, income statement, and cash flow statement. Together, they tell you where your business’s money is, and how it got there.

Let’s say you’re a freelance surfing instructor who bills clients for surfing lessons. Financial statements can tell you what your most profitable months are, how much money you’ve spent on supplies, and what the total value of your business is.

Financial statements can be generated fairly easily using accounting software, or you can have a bookkeeper do it for you.

Generally accepted accounting principles (GAAP)

Every company is different, but in order to make accurate financial comparisons between companies, we need a common language to describe each of them. That’s what generally accepted accounting principles (GAAP) are: a series of standards and procedures that accountants at all companies must adhere to when preparing financial statements.

GAAP are set by a nongovernmental body called the Financial Accounting Standards Board, and there are no laws enforcing them, but most lenders and business partners in the United States will require that you adhere to GAAP (if you’re in Canada, you’ll use a different system called International Financial Reporting Standards, or IFRS.)

The different types of accounting

Financial accounting

Every year, your company will generate financial statements that people outside of your company—people like investors, lenders, government agencies, auditors, potential buyers, etc.—can use to learn more about your company’s financial health.

Preparing the company’s annual financial statements this way is called financial accounting.

Managerial accounting

Managerial accounting is similar to financial accounting, with two important exceptions:

- The statements produced by managerial accounting are for internal use only.

- They’re generated much more frequently—often on a quarterly or monthly basis.

If your business ever grows to the point where you need to hire an accountant full-time, most of their time will be taken up by managerial accounting. You’ll be paying them to produce reports that provide regular updates on the company’s financial health and help you interpret those reports.

Tax accounting

When your accountant provides you with recommendations for how to get the most out of your tax return, that’s tax accounting.

Tax accounting is regulated by the Internal Revenue Service (IRS), and the IRS legally requires that your tax accounting adhere to the Internal Revenue Code (IRC).

Tax accounting is all about making sure that you don’t pay more tax than you are legally required to by the IRS.

Cost accounting

You’re doing cost accounting whenever you’re trying to figure out how to increase your margin, or deciding if raising prices is a good idea.

Cost accounting involves analyzing all of the costs associated with producing an output (whether it be a physical product or service) in order to make better decisions about pricing, spending and inventory.

Cost accounting feeds into managerial accounting, because managers use cost accounting reports to make better business decisions, and it also feeds into financial accounting, because costing data is often required when compiling a balance sheet.

Credit accounting

Credit accounting involves analyzing all of a company’s unpaid bills and liabilities and making sure that a company’s cash isn’t constantly tied up in paying for them.

Credit accounting can be one of the most difficult kinds of accounting to do well, because it usually involves telling someone something they don’t want to hear (like your accountant telling you that you should be borrowing less.)

Why accounting matters for your small business

Accounting helps you plan for growth

Every great journey begins with a roadmap. When you’re planning your company’s growth, it’s essential to set goals. What should your profits look like one year from now? How about in five years?

Financial statements let you properly assess how quickly your business is developing. Without accurate financial statements, it can be tempting to fall back on easy metrics like “sales growth,” which don’t give you the full financial picture.

Has your cost of goods sold increased? Are margins thinner? Are your growth goals reasonable? Without financial statements, you won’t have an objective answer.

Accounting is essential for securing a loan

Up-to-date financial statements demonstrate where your company stands. They’re essential if you want to fund your small business with a loan.

For instance, suppose you want to apply for a Small Business Association (SBA) loan through one of the big banks. You’ll need to provide, on average, three years of financial statements, plus a one-year cash flow projection. It’s virtually impossible to deliver any of these if you don’t have an accounting system in place.

You need accounting to get investors or sell your business

You may not be planning to court investors or sell your business right now. But it’s a good idea to leave your options open. And the best way to do that is to put a proper accounting system in place now.

Potential investors or buyers will expect accounting records that prove your business is profitable and on-track for growth. These records should be provided by a CPA.

Accounting helps you get paid

When a customer owes you money, it appears as Accounts Receivable (AR) on your balance sheet. This is either prepared by accounting software or your accountant.

The balance sheet tells you how much of your AR you’ve already pocketed during the month, and how much is still outstanding.

By referring to your balance sheet, you can track how effectively you’re collecting payment. Then you can put in place processes—harder payment deadlines, or better follow-up with clients—to make sure you get your hands on the money you’ve earned when you need it.

Accounting keeps you out of jail (or at least saves you from fines)

As your business grows, it can be difficult to keep track of all your tax information reporting obligations. What’s more, if there are mistakes in your financial reports, you run the risk of misreporting your income. Either mistake could land you in hot water with the IRS.

Solid accounting gives you complete, accurate financial records, which reduces your risk of breaking tax laws. And, when you have an accountant filing your taxes for you, you can be sure they’ll be done accurately and on time.

Accounting helps you pay the right amount of taxes (and not a dollar more)

If you don’t pay your full tax bill, the IRS will fine you. But they won’t give you a gold star for paying too much.

You can tell you’re paying too much in taxes if your business is consistently receiving large tax refunds.

Remember: a tax refund isn’t free cash from the IRS. It’s money that was held by the government while you could have been investing it in your business.

Refunds are often the result of miscalculated quarterly estimated tax payments. To calculate quarterly estimated tax payments accurately, you need to predict your income. It’s almost impossible to do so without accurate financial records produced through accurate accounting.

What an accountant does

A skilled accountant will save you time by communicating your company’s financial state to you jargon-free while anticipating your financial needs.

They can also provide you with knowledge and insight that is simply inaccessible to non-accountants. Things like tax deductions you didn’t even know you qualified for, tax rules you didn’t know you were breaking, and best practices picked up while working for other companies in your industry.

If those are things your business can benefit from right now, it might be time to hire an accountant.

Meet Kaitlyn. Your new bookkeeper.

Start a free trial with Bench. We’ll take bookkeeping off your hands, pairing you with a real, human bookkeeper—like Kaitlyn—at a price you can afford. We’ll even get your taxes filed for you.

What's Bench?

We're an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.

/investing8-5bfc2b8d46e0fb005144dbe3.jpg)