Steps in Risk Management Process

Steps in Risk Management Process

In the modern world, risk management has become a harsh reality. Over the years, organizations have found out that their operations and even their entire existence can be threatened due to external events. Hence, there is no point in going by hoping that adverse external events will only affect other organizations. Over the years, there has been a constant increase in the number of resources that are being devoted to the risk management process. In this article, we will have a closer look at what the risk management process is and how it enables the biggest organizations in the world to effectively manage their risk.

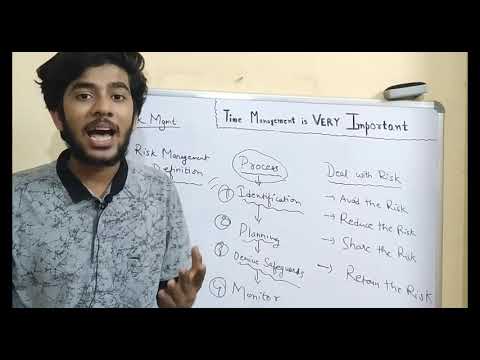

The Steps in the Process

The below article outlines a series of steps that need to be taken consistently within the company. Merely undertaking these steps once is not enough. These steps need to be taken repeatedly and routinely. Over time, the risk management process needs to be imbibed in the culture of the organization. The risk management process should become a part of the annual or biannual cycle of the organization. This will ensure that the process is iterated at different points in time.

- Step #1: Researching Your Risks:

The first step in risk management begins with the organization researching its risks and systematically noting down the results. Any organization can face different risks based on the business that it is in. There are some common risks such as risks of natural disasters. However, there are other risks such as technological risks. Companies that do not upgrade their technology risk being left behind. At the same time, companies that do upgrade their technology face the risk of not being able to manage the change appropriately. Many organizations also face "key person" risk. There are certain tasks in the organization which can only be performed by such key people. Alternatively, these are certain key people who bring in all the clients. Such organizations face a lot of risks if these people leave the organization. Also, in many cases, companies face the risk of litigation from the various activities undertaken by them and their subcontractors.

- Step #2: Classification of Risks:

Once a list of all the possible risks has been made, the next step is to categorize the risks. There are various frameworks that help in the classification of risks. Some of these frameworks have been mentioned in this module. However, the basics remain the same in all the models. Risks are classified by considering the probability of the risk materializing as well as the impact it would have if it did materialize. The next step is to create a priority list of risks.

- Step #3: Deciding Your Risk Philosophy:

It is important for the senior management of the company to be clear about the risk profile that they want to keep. Some organizations don't mind keeping a lot of risk on their books. This is particularly true of startups, who use risks in order to grow. On the other hand, there are other companies who want to keep their risk profile as close to zero as possible. The worst situation is when there is no unanimity about the risk profile. In such cases, some people in the senior management want to take risks whereas others do not want to do so creating ambiguity and leading to suboptimal outcomes.

- Step #4: Choosing a Strategy:

The risk management process in all companies is not the same. There is no single best way to undertake risk management activities. Instead, risk management can be undertaken using several different strategies. Some of the common ones are listed below:

- Risk avoidance

- Risk reduction

- Risk sharing

- Risk bearing

Different departments within the company may choose different strategies. Also, some departments may choose different strategies at different points in time. The details about the different types of risk management strategies have been mentioned in a different article in this module. The risk management strategy chosen should be congruent with the risk management philosophy stated in the previous step. This is the reason that the process must be followed exactly in the order that has been mentioned.

- Risk avoidance

- Step #5: Implementing the Strategy:

The next step in the process is to implement the chosen strategy. The implementation must be well defined and the results must be closely monitored to validate the effectiveness of the methods being used.

- Step #6: Review the New Risk Profile:

After the risk management process has been implemented by the team, the next step is to review the new risk profile. There are ways and means which have been designed using which the risk can be measured after the implementation. The new risk profile should be compared with the desired risk profile in order to determine whether the strategy has been successful. If the new risk profile is also beyond the limits of risk tolerance of the company then the same process needs to be repeated in iterations till the organization is comfortable with the risk leftover. This type of risk is called residual risk since it is the one that is left over after the strategy has been implemented by the firm.

As mentioned above, this process needs to be done in an iterative manner. This is because the risk an organization has, is relative to its environment. If the external environment changes, then so does the risk profile. Therefore it is important to keep scanning the environment and keep adjusting the policy accordingly.