Overview of Financial Modeling - What is Financial Modeling

What is Financial Modeling

What is a financial model?

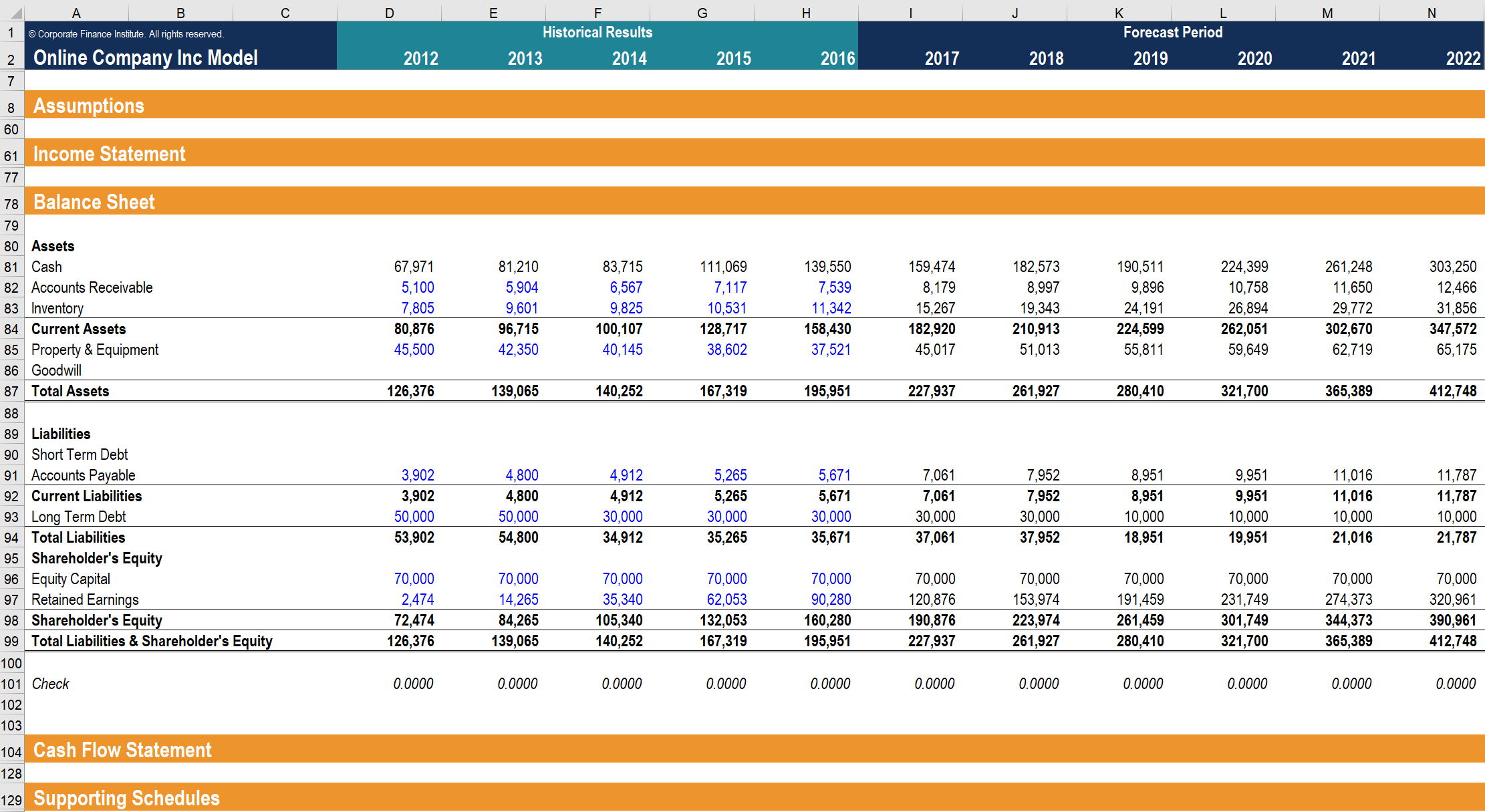

A financial model is simply a tool that’s built in spreadsheet software such as MS Excel to forecast a business’ financial performance into the future. The forecast is typically based on the company’s historical performance, assumptions about the future, and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (known as a 3 statement model). From there, more advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged-buyout (LBO), mergers and acquisitions (M&A), and sensitivity analysis. Below is an example of financial modeling in Excel.

Image: CFI’s Financial Modeling Courses.

What is a financial model used for?

The output of a financial model is used for decision making and performing financial analysis, whether inside or outside of the company. Inside a company, executives will use financial models to make decisions about:

- Raising capital (debt and/or equity)

- Making acquisitions (businesses and/or assets)

- Growing the business organically (e.g., opening new stores, entering new markets, etc.)

- Selling or divesting assets and business units

- Budgeting and forecasting (planning for the years ahead)

- Capital allocation (priority of which projects to invest in)

- Valuing a business

- Financial statement analysis/ratio analysis

- Management accounting

Who builds financial models? (jobs and career)

There are many different types of professionals who build financial models. The most common types of career tracks are investment banking, equity research, corporate development, FP&A, and accounting (due diligence, transaction advisory, valuations, etc).

To learn more about jobs and careers that require building financial models, explore our interactive career map.

How can you learn financial modeling?

The best way to learn financial modeling is to practice. It takes years of experience to become an expert at building a financial model and you really have to learn by doing. Reading equity research reports can be a helpful way to practice, as it gives you something to compare your results to. One of the best ways to practice is to take a mature company’s historical financials, build a flat-line model into the future, and calculate the net present value per share. This should compare closely to the current share price or the target prices of equity research reports.

It’s also important to establish a solid base understanding by taking professional financial modeling training courses such as ours offered at CFI, with many locations across North America or directly online. In the meantime, you may also be interested in having a go at building your own financial models. Feel free to use our available free templates to get a jump start before taking one of our courses.

Image: CFI’s Financial Modeling Courses.

What are financial modeling best practices?

1. Excel tips and tricks

It’s very important to follow best practices in Excel when building a model. For more details you can take our free Excel course, which outlines the following key themes:

- Limit or eliminate the use of your mouse (keyboard shortcuts are much faster)

- Use a blue font for hard-codes and inputs (formulas can stay black)

- Keep formulas simple and break down complex calculations into steps

- Ensure you know how to use the most important Excel formulas and functions

- Use INDEX and MATCH instead of VLOOKUP to query data

- Use the CHOOSE function to build scenarios

2. Formatting

It’s important to clearly distinguish between inputs (assumptions) in a financial model, and output (calculations). This is typically achieved through formatting conventions, such as making inputs blue and formulas black. You can also use other conventions like shading cells or using borders.

3. Model layout and design

It’s critical to structure a financial model in a logical and easy to follow design. This typically means building the whole model on one worksheet and using grouping to create different sections. This way it’s easy to expand or contract the model and move around it easily.

The main sections to include in a financial model (from top to bottom) are:

- Assumptions and drivers

- Income statement

- Balance sheet

- Cash flow statement

- Supporting schedules

- Valuation

- Sensitivity analysis

- Charts and graphs

Below is an example of the grouped sections of a well laid out financial model:

Get free financial modeling templates from CFI Marketplace.

How do you build a financial model? (10 Step Guide)

Financial modeling is an iterative process. You have to chip away at different sections until you’re finally able to tie it all together.

Below is a step-by-step breakdown of where you should start and how to eventually connect all the dots. For much more detailed instruction, and to work through your own Excel model, check out our financial modeling courses.

1. Historical results and assumptions

Every financial model starts with a company’s historical results. You begin building the financial model by pulling three years of financial statements and inputting them into Excel. Next, you reverse engineer the assumptions for the historical period by calculating things like revenue growth rate, gross margins, variable costs, fixed costs, AP days, inventory days, and AP days, to name a few. From there you can fill in the assumptions for the forecast period as hard-codes.

2. Start the income statement

With the forecast assumptions in place, you can calculate the top of the income statement with revenue, COGS, gross profit, and operating expenses down to EBITDA. You will have to wait to calculate depreciation, amortization, interest, and taxes.

Image: CFI’s Building a Financial Model in Excel Course.

3. Start the balance sheet

With the top of the income statement in place, you can start to fill in the balance sheet. Begin by calculating accounts receivable and inventory, which are both functions of revenue and COGS, as well as the AR days and inventory days assumptions. Next, fill in accounts payable, which is a function of COGS and AP days.

4. Build the supporting schedules

Before completing the income statement and balance sheet, you have to create a schedule for capital assets like Property, Plant & Equipment (PP&E), as well as for debt and interest. The PP&E schedule will pull from the historical period and add capital expenditures and subtract depreciation. The debt schedule will also pull from the historical period and add increases in debt and subtract repayments. Interest will be based on the average debt balance.

5. Complete the income statement and balance sheet

The information from the supporting schedules completes the income statement and balance sheet. On the income statement, link depreciation to the PP&E schedule and interest to the debt schedule. From there, you can calculate earnings before tax, taxes, and net income. On the balance sheet, link the closing PP&E balance and closing debt balance from the schedules. Shareholder’s equity can be completed by pulling forward last year’s closing balance, adding net income and capital raised, and subtracting dividends or shares repurchased.

6. Build the cash flow statement

With the income statement and balance sheet complete, you can build the cash flow statement with the reconciliation method. Start with net income, add back depreciation, and adjust for changes in non-cash working capital, which results in cash from operations. Cash used in investing is a function of capital expenditures in the PP&E schedule, and cash from financing is a function of the assumptions that were laid out about raising debt and equity.

7. Perform the DCF analysis

When the 3 statement model is completed, it’s time to calculate free cash flow and perform the business valuation. The free cash flow of the business is discounted back to today at the firm’s cost of capital (its opportunity cost or required rate of return). We offer a full suite of courses that teach all of the above steps with examples, templates, and step-by-step instruction. Read more about how to build a DCF model.

8. Add sensitivity analysis and scenarios

Once the DCF analysis and valuation sections are complete, it’s time to incorporate sensitivity analysis and scenarios into the model. The point of this analysis is to determine how much the value of the company (or some other metric) will be impacted by changes in underlying assumptions. This is very useful for assessing the risk of an investment or for business planning purposes (e.g., does the company need to raise money if sales volume drops by x percent?).

Image: CFI’s Sensitivity Analysis Course.

9. Build charts and graphs

Clear communication of results is something that really separates great from merely good financial analysts. The most effective way to show the results of a financial model is through charts and graphs, which we cover in detail in our advanced Excel course, as well as many of the individual financial modeling courses. Most executives don’t have the time or patience to look at the inner workings of the model, so charts are much more effective.

Image: CFI’s Advanced Modeling Course (Amazon Case Study).

10. Stress test and audit the model

When the model is done, your work is not over. Next, it’s time to start stress-testing extreme scenarios to see if the model behaves as expected. It’s also important to use the auditing tools covered in our financial modeling fundamentals course to make sure it’s accurate and the Excel formulas are all working properly.

Free financial modeling video lesson

Want to see all the above steps in action? Check out CFI’s free webinar video about how to build a 3 statement financial model in Excel from scratch. This live demonstration will show steps 1 – 6 listed above. Steps 7 – 10 are covered in more advanced financial modeling classes.

More about financial modeling

We hope this has been a helpful guide on what financial modeling is all about and how to perform it. CFI is the official global provider of the Financial Modeling and Valuation Analyst (FMVA)® designation.

If you want to learn more, CFI has all the resources you need to advance your career: