IZA World of Labor - How does international trade affect household welfare?

How does international trade affect household welfare?

Households can benefit from international trade as it lowers the prices of consumer goods

University of Alberta, Canada

Elevator pitch

Imported products tend to have lower prices than locally produced ones for a variety of reasons, including lower labor costs and better technology in the exporting country. The reduced prices may lead to wage losses for individuals who work in the production of a local version of the imported item. On the other hand, lower prices may be beneficial to households if the cheaper product is in their consumption basket. These welfare gains through consumption, on average, are found to be larger in magnitude than the wage effect for some developing countries.

Key findings

Pros

International trade tends to reduce the prices of consumption goods, creating welfare gains for consumers in importing countries.

Welfare gains through reduced costs of consumption may be larger than gains or losses through income changes.

In developing countries, the welfare effect of unilateral trade liberalization through consumption tends to be pro-poor.

Welfare gains from trade are larger for households that live in urban areas and that are closer to national borders.

Households that participate in the production of exported products may experience further welfare gains in addition to gains through cheaper consumption goods.

Cons

Earnings may be reduced depending on an individual’s skill level and the impacted industry’s level of exposure to international trade.

Income effects can be pro-rich if agricultural wages decline due to trade liberalization.

Welfare gains through consumption are expected to be pro-poor only if the cheaper imports are relatively important in poor households’ budgets.

Welfare gains through consumption may be smaller for households that are isolated from price effects due to low competition in their region.

Households with skilled labor may experience smaller welfare gains in developing countries.

Author's main message

International trade is known to reduce real wages in certain sectors, leading to a loss of wage income for a segment of the population. However, cheaper imports can also reduce domestic consumer prices, and the magnitude of this impact may be larger than any potential effect occurring through wages. Research on some developing countries suggests that most households experience net gains in welfare and that the distributional effects are progressive. Policymakers should, therefore, consider the impacts on consumer prices when evaluating how trade affects households in their roles as both consumers and producers.

Motivation

Consumption and income are the two main channels through which the welfare of a household may be affected by international trade. The first channel works via the impact on household expenditure, as the total cost of consumption for households is altered through the influence of trade on the prices of consumption items. The second channel works via the impact on earnings, as international trade may affect the wage incomes of individuals, based on their industry affiliation or skill level.

If consumer prices decline in a way that benefits households, the gains through this channel may be substantial, and households may experience overall welfare gains, even in the presence of wage losses. It is therefore important to consider the additional impact on a household’s budget when analyzing the impacts of international trade.

Discussion of pros and cons

The set-up of household welfare

Households are complex establishments that contribute to the economy as both producers and consumers. Household members who participate in the labor market earn wages, and these wage incomes partially or fully determine the total household budget. A change in trade policy influences household welfare through its effect on wage incomes, as well as through its effect on the cost of consumption goods. Whether or not a household benefits from international trade depends on the relative magnitude and the direction of these two effects. Figure 1 summarizes these main linkages between trade policy and household welfare.

An important study outlined a framework showing how households can be affected by price changes through different channels [2]. The author investigated the effects of removing a rice export tax in Thailand. He considered producer and non-producer households that both consume and participate in the labor market. By separating the components in the definition of household welfare into production and consumption, the author could study them independently to identify and quantify the different sources of welfare effects across households. Overall, the results showed that producers at all levels of income experienced welfare gains, but the major beneficiaries were households in the middle of the income distribution. While producer households benefited more, only a small share of households at the high end of the income distribution were producers, leading to a lower average effect at the high end. On the other hand, while there were many producer households at the low end of the distribution, they were net consumers, with rice making up a large share of their budgets, and thus did not benefit as much from the removal of the export tax. As a result, the overall gains at the low end of the distribution were similar to the overall gains at the high end of the distribution.

The above approach of separating consumption effects from income effects highlights the importance of other empirical factors that are often ignored in traditional analyses of the distributional effects of trade. Several of these factors, such as labor force participation, the industry in which household members are employed, and the share of the working age population within households, may change across the income distribution, thus playing an important role in determining whether trade has a pro-poor, pro-rich, or neutral effect overall. Additionally, the industry composition of employment, i.e. the share of the workforce employed in different industries, may vary across the income distribution. For example, if wages in the manufacturing sector are reduced due to trade, it is important to know whether there are different shares of employment in this sector among poor and rich households.

A more recent study has since extended this framework in order to analyze the distributional effects of more comprehensive changes in trade policy [3]. This study considers two main linkages. First, internationally tradable goods (e.g. agriculture, manufacturing, and mining products) in the domestic market might see a price change as the barriers to trade are reduced and trade expands. The prices of non-tradable services (e.g. communications, education, health, housing, and transportation) may also be affected as production adjusts to the expansion of trade. Second, these price changes in the domestic market of the importing country affect households by influencing their labor incomes and their consumption baskets. The magnitude of these effects will vary across households with different skill levels, different industry affiliations, and different weights of importance for each product in their basket. By evaluating these effects for each household and summing up their impacts, one can obtain a net welfare impact for each household. The overall net welfare effect would be the population-adjusted average across all households. More importantly, households with different income levels can be compared in terms of their welfare changes to evaluate whether international trade has had an overall pro-poor, pro-rich, or neutral effect.

Impact on wages

In the 1980s and early 1990s, many developing countries went through extensive trade liberalization, including Argentina, Brazil, Chile, Colombia, India, and Mexico. Most of these countries observed increases in inequality after their trade liberalization took place. Increases in skill premiums and other measures of wage inequality tended to coincide with these trade reforms [4]. However, the positive correlation between trade and wage inequality is less clear when the causal effect is considered. In India, for example, tariff reductions were found to increase wages overall, and the effect was more pronounced for unskilled workers. As a result, the distributional effect through wages was pro-poor, with the largest gains experienced by households with the lowest per capita incomes [1]. On the other hand, another study found that real wages and agricultural wages in India decreased relatively more in areas with higher exposure to international trade [5]. Across six African countries, including Burkina Faso, Cameroon, Côte d’Ivoire, Ethiopia, Gambia, and Madagascar, the existing structure of trade protection is found to have a pro-rich bias through wages, implying that trade policy in these countries protects skilled labor more than unskilled labor [6].

In developed countries, such as the US, wage inequality between skilled and unskilled labor has also been increasing. Moreover, for most developed economies in the 1980s and early 1990s, increased international trade and rapid technological change occurred simultaneously. Given that both effects tend to influence inequality in a similar fashion (i.e. by expanding the gap between skilled and unskilled wages), the disentangling of their impacts remains a key challenge. Because it is easier to observe and quantify international trade, such expansions are often associated with globalization. However, an earlier study concluded that an increase in the wage premium among college graduates during the 1980s was mostly due to skill-biased technological change, rather than globalization [7]. Recent literature revisits this result by focusing on the period after China joined the World Trade Organization in 2001, when it began exporting large amounts of low-skill-intensive manufacturing items to developed countries. A recent study showed that the expansion of Chinese imports to the US led to a larger reduction in earnings for US workers, with lower initial earnings, lower initial tenure, and less of an attachment to the labor force [8]. This result suggests that the rise of Chinese imports has contributed to the increased wage inequality in the US.

While it is beyond the scope of this article to provide a complete review, the linkages between international trade and wage inequality are widely debated. The mechanism through which trade affects wages and their distribution is linked to the relative amount of skilled labor used in the production of the traded good. A country that exports low-skill-intensive products experiences an increase in the prices of low-skill-intensive products in their home market. This leads to a rise in the real wages of workers with low skill levels, and a reduction in the real wages of workers with high skill levels, thus reducing wage inequality. On the other hand, a country that exports high-skill-intensive products will experience a rise in high-skill real wages, and a reduction in low-skill real wages, thus increasing wage inequality. Because developing countries are relatively abundant in low-skilled labor, standard trade theory predicts that trade should reduce income inequality in developing countries, and increase income inequality in developed nations.

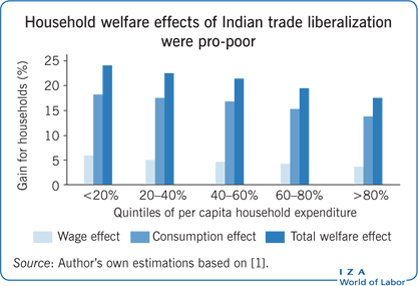

The household-level welfare effect of wages is slightly different from the effect on hourly wages. First, welfare is affected by changes in earnings, which are calculated as wages multiplied by total hours worked. Therefore, the differences in labor supply are also incorporated into the welfare effect. Second, the welfare effect is proportional to a household’s relative reliance on wages [2]. If the household has many non-wage income sources, or if the share of wages from affected industries is small relative to the total family income, then the household welfare effect will be small even if the pure effect on hourly wages is substantial. It is therefore important to know the distribution of economic activities both across households and within households. The results for India suggest that the welfare effect from increased wages has been pro-poor [1]. This can be seen in the Illustration, which shows that the welfare gains through wage incomes are about 6% for households in the poorest quintile, and decrease to roughly 3% for the richest households. This is because unskilled labor benefited relatively more from the tariff reductions, and poorer households tend to have more unskilled labor. Similarly, a pro-poor impact was found for Argentina, where the welfare effect through changes in wages was estimated to be about 7% for middle-to-low income households, while rich households experienced close to a 5% welfare loss [3].

However, the welfare of households does not only include their wages. From a household’s point of view, this is only one side of the story, since consumer prices also change as a result of international trade. Therefore, one must also consider the consumption effect, which takes into account these trade-induced price changes on the expenditure of households. Consider households with low skill sets and tight budgets. If changes in prices lower their wages due to a country-wide reduction in the returns to unskilled labor, while simultaneously making the consumption basket cheaper, these households may end up being better off when the net effect is considered.

Impact on consumption

Tradable merchandise

In developing countries, consumer products that are internationally traded constitute a very important portion of household budgets. The changes in their prices therefore have significant welfare effects. One of the most important tradable product categories, food and beverages, may constitute the entire budget for the poorest households. This budget share of food is lower in developed nations, where incomes are higher, according to the US Department of Agriculture’s Economic Research Service. In 2014, the share of consumer expenditure on food, alcoholic beverages, and tobacco was 6.6% in the US, 8.7% in Switzerland, and 10.2% in Germany. On the other hand, the share of food was 17.7% in Colombia, 21.6% in Turkey, and 42.1% in the Philippines. Moreover, this share tends to be higher for poorer households and then falls as income increases. In India, for example, this share was about 57% for the poorest households and decreased to roughly 10% for the richest households.

The negative relationship between the share of food expenditure and income is one of the most basic observations in development economics. It is described by Engel’s Law, which states that the percentage of income allocated to food decreases as income rises. Suppose that the cheapest available calorie in a country is rice, and an individual requires about 20kg of rice every month in order to consume a sufficient amount of calories. If 1kg of rice costs $5 and her income is $100, then this individual will allocate all of her income to food. As her income rises, she may start to consume better quality calories (thus continuing to spend her entire income on food), but, eventually, she will be able to allocate some of her increasing income to other items, such as textiles and housing, and the share of food in her total budget will decline.

This relationship indicates that any reduction in food prices will have a pro-poor effect, holding everything else constant. Welfare gains through consumption are expected to be pro-poor only if cheaper imported goods are relatively more important in poor households’ budgets. Given that trade liberalization lowers the domestic prices of tradable goods, there should be a welfare gain due to the lower cost of food. This straightforward prediction, however, is somewhat complicated by the addition of other tradable merchandise. Manufactured items, such as automobiles, household durables, and textiles, tend to have a higher budget share among richer households. In India, manufacturing expenditure is only about 13% for low-to-middle income households, while it increases to roughly 58% for the highest income households. These price reductions for manufactured goods due to trade liberalization indicate higher welfare gains for richer households, as opposed to poorer ones.

Overall, Figure 2 shows that the budget share of tradable merchandise, including agricultural, manufacturing, and mining products, is about 87% among the poorest quintile in India, and decreases to around 62% for the richest quintile. An estimate of the consumption effect of trade liberalization can be obtained by evaluating the impact of domestic prices on household expenditure. A household that experiences a wage loss due to international competition may also see a reduction in their cost of consumption, and hence experience a net welfare gain due to international trade. Studies that have investigated the impact of unilateral trade liberalization episodes found that the distributional effects of international trade were progressive. The effects were pro-poor in India, where 18% of the welfare gain at the bottom end of the distribution decreases to 13% at the top end of the distribution (see the Illustration) [1]. Additionally, in China, the welfare gains were as high as 13% at the bottom end of the distribution, while they were statistically insignificant at the top end [9]. On the other hand, joining the regional trade agreement of Mercosur brought about pro-rich consumption effects in Argentina, where welfare losses of up to 0.5% were experienced among the poorest households and welfare gains of 0.75% were seen among the richest ones. The main reason was that joining Mercosur increased prices for food items in Argentina [3]. One study investigated the bias of existing trade policies in sub-Saharan African countries. This study found that trade policy has a pro-poor bias through consumption effects in Burkina Faso and Gambia. On the other hand, this bias is pro-rich in Cameroon, Côte d’Ivoire, Ethiopia, and Madagascar, because a large share of consumption items among poor households were not affected by trade policy [6].

Non-tradable services

While the prices of tradable products are directly impacted by trade policy, non-tradable services are only indirectly impacted after all the resulting adjustments in the economy have taken place. In Argentina, non-tradable prices were shown to respond to changes in the prices of tradable goods [3]. Accordingly, food and beverage prices were negatively related to the prices of education and health, and positively related to communications, housing, and transportation. The directions of these relationships were found to be similar in China [9].

The two studies above interpreted the estimated indirect effects in terms of labor market adjustments. If a relatively unskilled-labor-intensive tradable sector experiences a price increase due to trade liberalization, then the relative wage of unskilled labor increases. This wage increase leads to higher prices in the relatively unskilled-labor-intensive non-tradable sector, while reducing prices in the relatively skilled-labor-intensive non-tradable sector. For example, a price increase in the food industry causes an expansion in food production, and thus relative demand for unskilled labor increases. This pushes up the wages of all unskilled labor in the economy, leading to price increases in non-tradable sectors that use unskilled labor intensively, such as housing. While this theory is not directly tested in the two studies, their results are consistent with its interpretation. However, the magnitudes of these effects are still quite small. One potential reason is that services, such as education and health, are highly regulated, so their prices do not efficiently adjust to changes in market conditions.

The budget share of non-tradable goods also tends to be smaller among poor households, especially in developing countries. This is an important empirical fact for assessing the distributional effect, as it implies that the direct effect of trade-induced price changes is more important for poor households. Figure 2 shows that the poorest Indian households only spend about 20% of their budget on non-tradable services, whereas this share rises to 44% for the richest households [1]. Similarly, in China, the share of non-tradable goods varies between 18% and 28% across Chinese cities [9]. Consistent with these low budget shares and limited responses of prices, the welfare effect through non-tradable goods and services is generally small in magnitude. In Argentina, it varied between 0.3% and 1% [3] across the income distribution, while it was estimated to be around 0.7% in China [9].

The net welfare effect

The net impact of trade on household welfare is evaluated by assessing the impact on incomes in proportion to the importance of the affected income channel in a household’s total income, as well as the impact on the cost of their consumption basket. The distribution and relative magnitude of these channels determine whether international trade has a pro-poor or pro-rich effect on household welfare. In India, the proportion of skilled workers increases when moving up the income distribution, implying that a real wage increase among unskilled workers would benefit poorer households more than richer households. On the other hand, the share of workers in tradable sectors decreases when moving up the distribution. Because tradable sectors are more likely to see a wage loss due to lower domestic prices, this suggests that low income households would be disproportionately hurt by those wage losses.

These distributional effects of wages may be offset by the consumption effects, leading to an overall positive impact on welfare. In terms of distribution, if the tradable consumption items experience price declines, and if they are relatively more important for poorer households, then this channel would lead to a progressive effect (i.e. a larger effect on poorer households compared with richer ones). This is found to be the case in India, where both the wage effects and consumption effects were positive, and the magnitude of the consumption effect was much larger, which translates into the trade policy inducing positive and pro-poor impacts [1]. The Illustration shows that households in the poorest quintile experienced welfare gains of 24%, whereas the gains were lower for households in the highest quintile, at only 17%. This is consistent with the result presented in another study, which states that trade liberalization has helped to reduce poverty in India [10]. The welfare analysis above would also suggest this. The national poverty line in India is determined by a basket of products that provide a certain amount of calories. If trade lowered the cost of this consumption basket, while also disproportionately raising wages for poorer households, then this would mean a reduction in poverty.

The net effects were also found to be progressive in Argentina, where the poorest households experienced sizable welfare gains, whereas these gains declined along the distribution until the richest households experienced a welfare loss [3]. In Mexico, the net effects of trade liberalization have been regressive, with small gains for poor households, but much larger gains for rich households [11]. Results on the bias of existing policy in Burkina Faso, Cameroon, Côte d’Ivoire, Gambia, and Madagascar suggest that trade protection has had a pro-poor bias [6]. However, in Ethiopia, trade policy has protected rich households relatively more, and has had regressive effects through sales, wages, and consumption [6].

Factors that influence the effect on consumer prices

To what extent are domestic prices influenced by trade? The literature examining episodes of trade liberalization in developing countries focuses on the pass-through of tariffs onto consumer prices. The tariff pass-through elasticity indicates the extent to which prices are reduced for a 1% reduction in tariff rates. There are various channels through which tariffs affect prices. Earlier literature focused on the imperfect competition among exporters, and showed that foreign exporters with market power may not allow tariff reductions to be fully reflected in prices, as they find it optimal to absorb a portion of the price effect [12].

On the other hand, the recent literature shows that domestic factors also affect the transmission of prices from a country’s border to consumers. This implies that pass-through rates may be different across regions within the same country. In developing countries, certain markets are quite isolated and do not have full access to the rest of the economy. The price transmission in such rural markets is found to be lower than in the well-connected urban markets. In India, a 100% reduction in tariffs implied a close to 68% reduction in domestic prices in urban areas, but only about a 49% reduction in rural areas [1]. The local infrastructure, especially transportation facilities such as paved roads and railways, may further affect the rate at which trade policy influences local prices, and the distance to the border or the distance to major ports could also be of importance. For example, Mexican provinces that are closer to the US border are found to have much higher tariff pass-through rates. The price transmission in the manufacturing industry is as high as 70% at the US border, but declines to about 40% when moving 1,000km away, and to about 20% at 2,000km [11].

Even when markets are not isolated and there are no regional differences, there are still various factors that may lead to low pass-through rates, or different pass-through rates across products. The organization of the domestic market is expected to play an important role. In China, cities with a higher share of state-owned enterprises have especially low pass-through rates, potentially due to inflexible price-setting policies at these enterprises [9]. A city with an average sized private sector, by Chinese standards, has about a 31% pass-through rate; this rate increases by about two percentage points with each 10 percentage point increase in the size of the private sector. The lack of competition among retailers may also affect price transmission. Recent evidence in the exchange rate pass-through literature shows that the retail sector plays an important role in the extent to which exchange rates pass through onto consumer prices [13]. The market penetration of imports is also important in determining the average effect on the price of a commodity. If imported varieties constitute only a small share of the market, then the average effect would be smaller, and the expectation would be to observe less of an impact on a household’s budget [9].

Limitations and gaps

There are many components of household welfare that can potentially be affected by trade policy which are not captured by the approach taken in this article. These channels may include remittances and agricultural profits, as well as other welfare effects through changes in education and health status. In addition, the strand of research discussed in this article compares consumers with a fixed consumption basket, rather than allowing consumers to respond to price changes by adjusting their consumption basket. In other words, consumer behavior is not incorporated into estimates. This channel can potentially increase the magnitude of the consumption effect as the budget share of goods that are now cheaper due to trade would increase. The estimates can thus be interpreted as the lower bound of consumption effects.

Furthermore, households choose different varieties of each product, and the imported variety may be of a different quality than the locally produced variety. For instance, poorer households may choose lower quality products at a lower price. While the variety choice may have additional welfare effects, assessing the price impact for each variety is difficult. For this reason, the price effects should be interpreted as the average price effect across all varieties of a given product.

Summary and policy advice

International trade affects the prices of consumer goods that are produced and sold in the domestic market, which leads to changes in the wages received by individuals. These price changes also affect the cost of households’ consumption baskets, leading to potential welfare gains if the trade-induced price reductions are more highly concentrated in products that are relatively more important to the household budget. The net welfare effects may be positive for households if the impact on their budget is larger than the impact on their income (i.e. if price reductions to the consumption basket are greater than any lost income). This may lead to a reduction in poverty and consumption inequality, even if there are net wage losses or the distributional effects through wages are regressive.

Any policy discussion on the impacts of trade on inequality, poverty, and household welfare should include (i) the potential effect on earnings, (ii) the potential effect on consumer prices, and (iii) how these effects are distributed across households with different incomes.

The welfare benefits due to lower prices can be enjoyed by more households if markets are able to transmit these price changes. For this reason, improvements in market competition among final goods producers and retailers, as well as improvements in transportation infrastructure, also work to increase the extent to which households benefit from international trade.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author (co-authored with Jun Han, Rana Hasan, Devashish Mitra, Runjuan Liu, and Junsen Zhang) contains a larger number of background references for the material presented here and has been used intensively in all major parts of the article [1], [9], [10].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

)