Financial Modeling Skills - The Top 10 Skills You Must Have!

This free guide outlines the top 10 most important financial modeling skills required to be a world-class financial analyst. Financial modeling is the art of building a dynamic tool (an Excel model) that can be used to evaluate investment opportunities, mergers & acquisitions (M&A), capital raising, or to assess a company’s historical or forecasted financial performance.

The most important financial modeling skills are:

- A solid understanding of accounting

- Strong Excel skills

- Knowing how to link the 3 financial statements

- Understanding how to build a forecast

- A logical framework for problem-solving

- Attention to detail

- Ability to distill large amounts of data into a simple format

- An eye for design and esthetics

- Clear presentation skills

- The ability to easily zoom in on details, and zoom out to high-level strategy

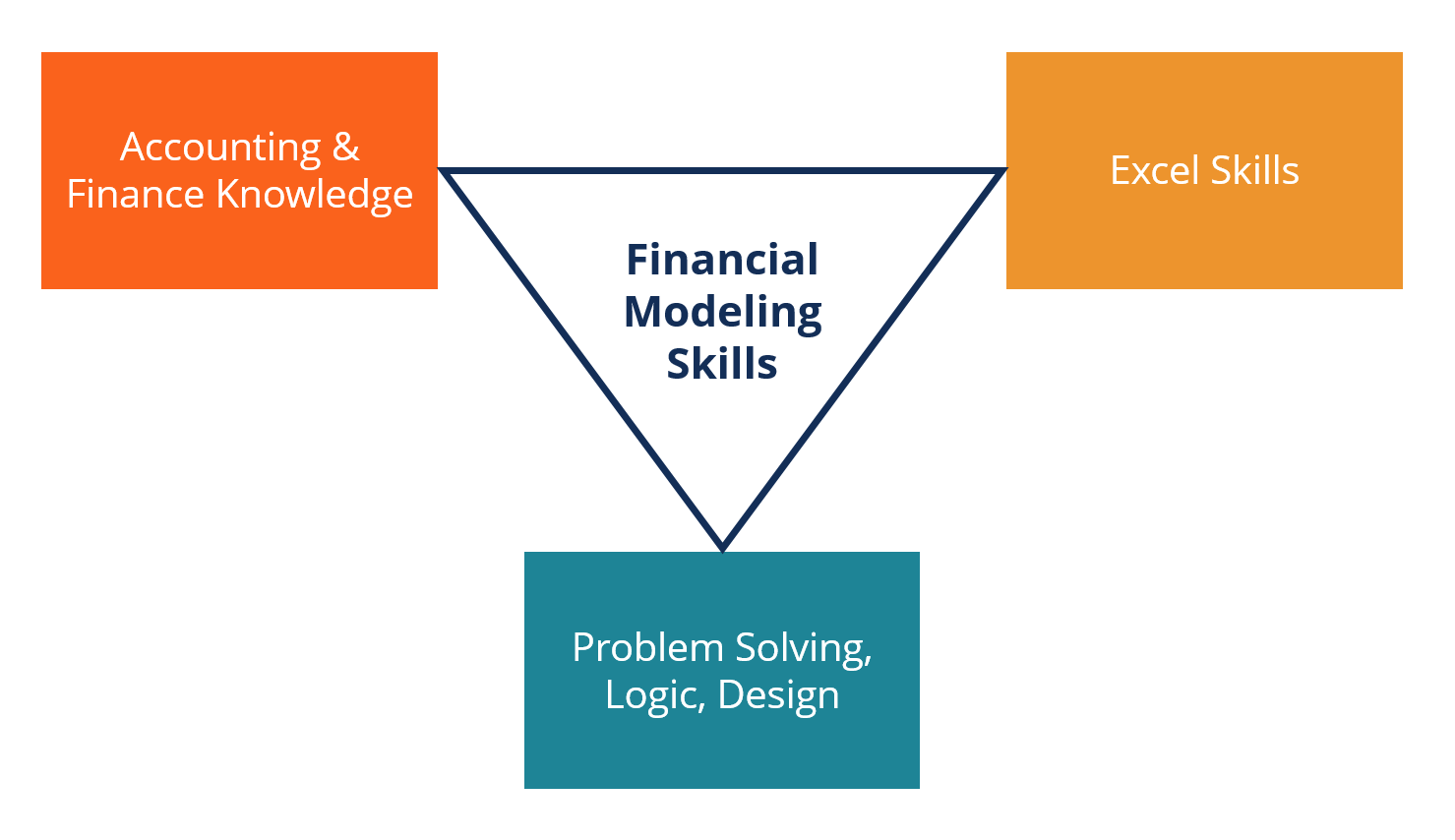

Each of these financial modeling skills is broken down in further detail below. As the image below shows, these skills can be divided into 3 categories: accounting/finance, Excel, and problem-solving/logic/design.

Top 10 financial modeling skills:

#1 Accounting skills

In order to build a financial model, it’s important to possess a solid understanding of accounting fundamentals. This includes concepts such as the matching principle, accruals, revenue recognition, non-cash items such as depreciation, amortization, and more. You need to have sufficient accounting skills to understand how to read financial statements, how to dissect them, and how to build them back up again.

#2 Excel skills

Strong Excel skills are critical for financial modeling. Creating financial models can sometimes be more of an art than a science. You’ll need to know all the main keyboard shortcuts to help save time and build models as quickly as possible. You’ll also need to know all the main formulas and functions to perform calculations and financial analysis.

Check out our Free Excel Course to make sure you have the basics down! We’ve also listed the top 10 advanced Excel formulas you must know.

#3 Linking the three financial statements

Another skill that’s very important is being able to link the 3 financial statements. This means taking historical financial statements (income statement, balance sheet, and cash flow statement) and dynamically linking them together in Excel. For example, connecting net income on the income statement to retained earnings on the balance sheet. This can be one of the trickiest skills to master, but as with any other skill, practice makes perfect.

Free step-by-step guide here: How to link the 3 financial statements in Excel. Or, watch our free webinar and video demonstration of linking the statements.

#4 Forecasting skills

Being good at forecasting is definitely both an art and a science. An analyst can use regression analysis to predict future results based on historical results. Don’t let the science of regression give you false confidence though, as it still requires making major assumptions about future unknowns. In addition, qualitative factors such as the management team and culture have to be taken into account. Learn more in CFI’s forecasting course.

#5 Problem-solving skills

A good financial analyst has the ability to think logically and in a very organized manner. When building a financial model, it’s important to follow a logical flow of information so that other users can easily understand what you’ve done when they jump into your Excel file.

For more on what it takes to be a great financial analyst, check out our free guide outline our proprietary process called The Analyst Trifecta.

#6 Attention to detail

This is an absolutely essential skill for financial modeling. Given the vast amount of information and the intricate nature of a complex model, if you don’t have attention to detail, you’re not likely to be great at financial modeling. Fortunately, training yourself to pay attention to details is mostly just a matter of developing that habit if you don’t already have it.

Check out our financial modeling courses to see the level of detail that’s required.

#7 Simplification of complex information

One of the hallmarks of a someone with great financial modeling skills is their ability to distill large amounts of complex information into a simple format. As Leonardo da Vinci said, “Simplicity is the ultimate sophistication”.

Check out our Advanced Excel Skills Course to learn how to simplify complex information.

#8 Design skills

One of the least discussed, yet most important, financial modeling skills is having an eye for design and aesthetics. A good financial model is easy to follow and easy on the eyes – it should have clean formatting, beautiful charts and graphs, and look professional. This is one of the 3 pillars of our Analyst Trifecta method, which we outline in our guide on how to be a great financial analyst.

#9 Presentation skills

A great financial modeler will also be able to create an effective PowerPoint Presentation and Pitchbook to communicate the results of the model to managers, executives, or clients.

#10 Detail vs high-level strategy

A great analyst possesses the rare ability to easily zoom in on extreme levels of detail in a model and then quickly zoom out to high-level business strategy. Most people are stronger at one than the other, however, some people have the rare gift of being good at both.

Examples of Financial Models

Here are some screenshots of sample financial models from CFI’s online financial modeling courses:

Different Types of Financial Models

We’ve outlined in detail the various types of financial models, which include:

- 3 statement model

- DCF analysis

- LBO model

- M&A model

- Sensitivity analysis model

- And many more

Another way to get acquainted with the different types of financial models is to purchase all of our financial modeling templates and work through them yourself.

Video Explanation of Top 10 Financial Modeling Skills

Below is a video explanation of the top 10 most critical financial modeling skills any financial analyst should have to succeed in their career!

More Financial Modeling Resources

We hope you now have a thorough understanding of the various financial modeling skills required to be a world-class financial analyst. CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a top-flight financial analyst. You may want to check out some of our other popular resources, including the following: